We specialise in helping businesses claim Research and Development (R&D) tax relief.

With over a decade of experience in the R&D market, we have successfully assisted hundreds of businesses in claiming over £10 million in R&D tax relief.

Our mission is to ensure that businesses like yours maximise their potential by accessing the financial benefits they deserve.

![[Original size] JJMK Consultants Logo [Original size] JJMK Consultants Logo](https://jjmkconsultants.co.uk/wp-content/uploads/2023/06/Original-size-JJMK-Consultants-Logo.gif)

The Oil & Gas Industry relies heavily on research & development. Qualifying activity can involve improvements in extraction, refining, packaging and transportation.

Businesses within the UK's professional sports sector often conduct valuable R&D to identify new and improved ways of developing sports equipment, sports applications, software and even development and testing of unique nutritional plans

Agriculture

The sector is currently benefiting from advances through technology. Qualifying activity can include process improvements, production improvement, scalability and quality control

Manufacturers benefit from the highest average R&D claim value. R&D activity stretches from product development, production line speed and resource improvement to quality control and compliance. Each incremental challenge and solution can also qualify.

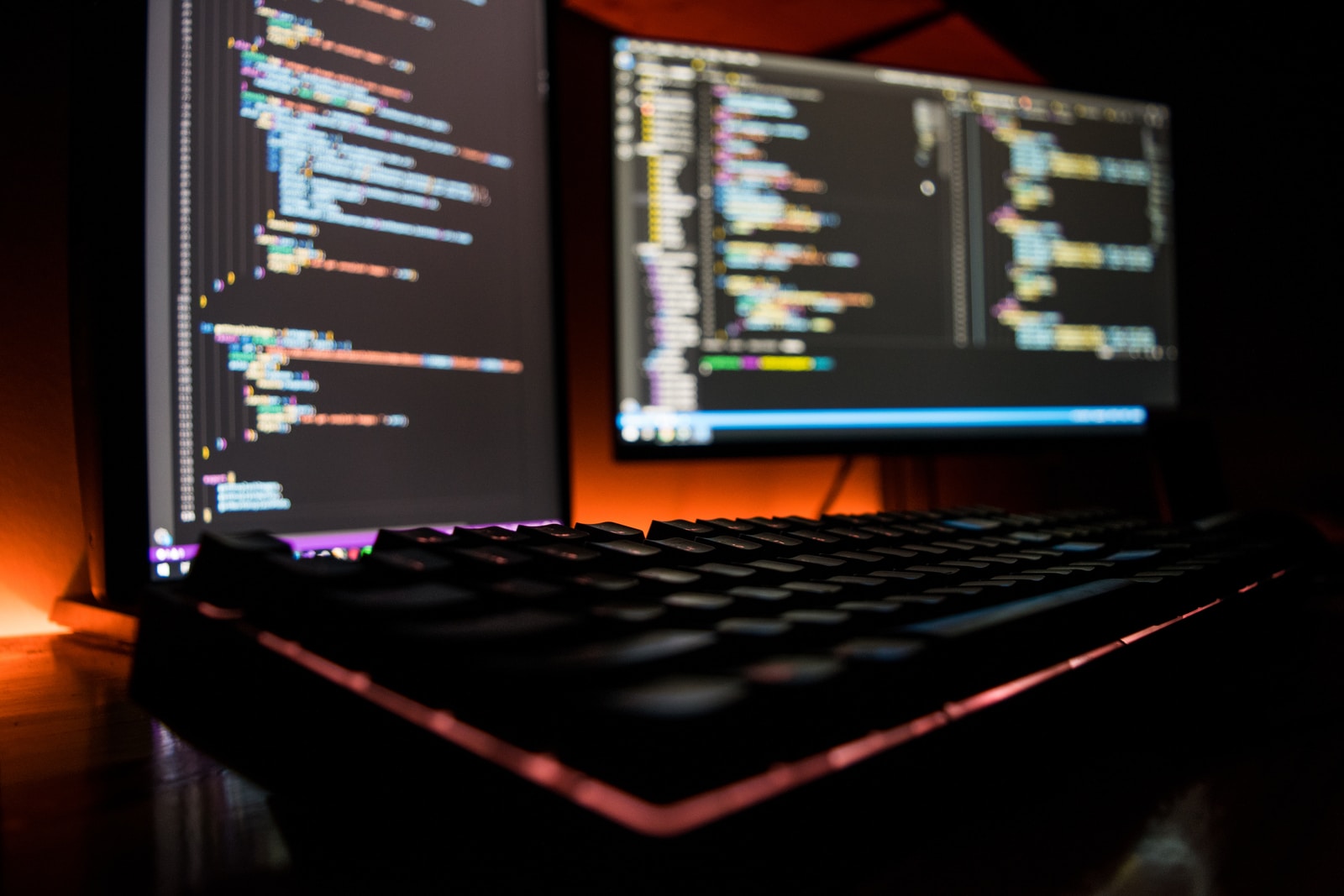

Innovation in software can be demonstrated by using technology to address different challenges with different clients. Qualifying activity can also be bespoke methodology or unique architecture solutions

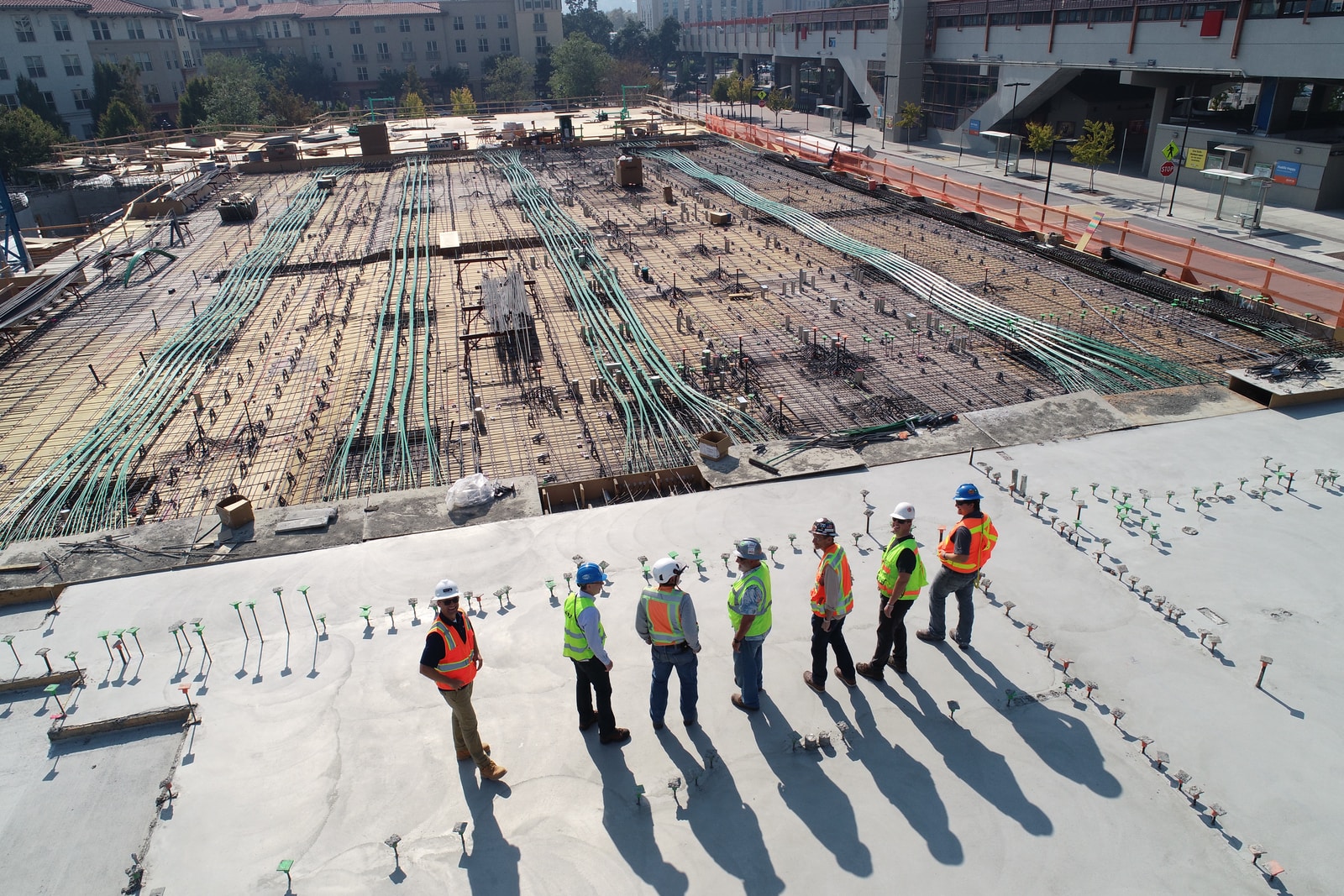

Engineering

As an industry, engineering remains full of innovation in the UK. Engineering companies continually invest in research and development to solve technical problems and develop new products or techniques

"The team at JJMK were friendly and easy to work with, taking care to explain everything thoroughly, answering questions patiently. They really minimised our pain in putting the claim together and their advice meant our claim was successful. We plan to use JJMK again in the future."

"I got in touch with JJMK about R&D tax credits where the deadline for an important claim was fast approaching. Their support and guidance was spot on, and they hit the deadlines despite being very tight. I would recommend JJMK to anyone who is considering an application for R&D tax."

"Before engaging with James and the JJMK team, we had never heard of R&D Tax. Throughout the process we have been impressed with their knowledge and efficiency. We've put the money back into the business, it's helped us to expand quicker than we had planned."

Are you receiving funding for your innovation?

If you are interested in learning more, don't hesitate to contact our team!